Three Reasons Why a High Churn SaaS Business Will (Probably) Never Make Money

How will we look back on 2021 and 2022 years from now?

I’m sure partly, we will reflect with shock. How did we ever think GameStop was worth tens of billions of dollars? Why did we believe in crypto scams like FTX? And whoever thought an NFT of a “Bored Ape” would be valued at millions? What were we thinking?

On the flip side, we might have some nostalgia for the halcyon days of SaaS when everything was worth 100x ARR, regardless as to business model! No matter what, we are in a new and more real world. And the real world demands that businesses eventually make money.

Having led SaaS companies for almost 15 years now, I can tell you that profitability in SaaS comes down to three variables:

- Net Revenue Retention: How much will that client grow or shrink over time?

- Gross Margin: What’s the gross profit you will make on that customer?

- Customer Acquisition Cost: How much Sales and Marketing expense does it take to get a new client?

Other things—like R&D cost and G&A—matter. But they naturally scale down over time for most businesses.

Let’s reflect on each of those three levers and see how customer success (CS) and churn fit in.

1. Low Net Retention Means Your “Steady State” Model Isn’t Very Profitable

In the early days of companies, growth is usually fast, often with ARR doubling or tripling the prior year. But inevitably, “gravity” sets in. You reach the frontier of your market and your growth will slow down. As that growth slows, your core question becomes: What is the “terminal” growth rate and how profitable will the company be at that time? The terminal growth rate is the constant rate that a company is expected to grow into perpetuity. Investors will already be wrestling with this when they value your company. Some businesses at scale grow 20% and have 40% operating margins. Others grow 5% and barely make any money. What’s the difference?

I’d argue the biggest issue that makes terminal growth not very profitable is when you have high churn.

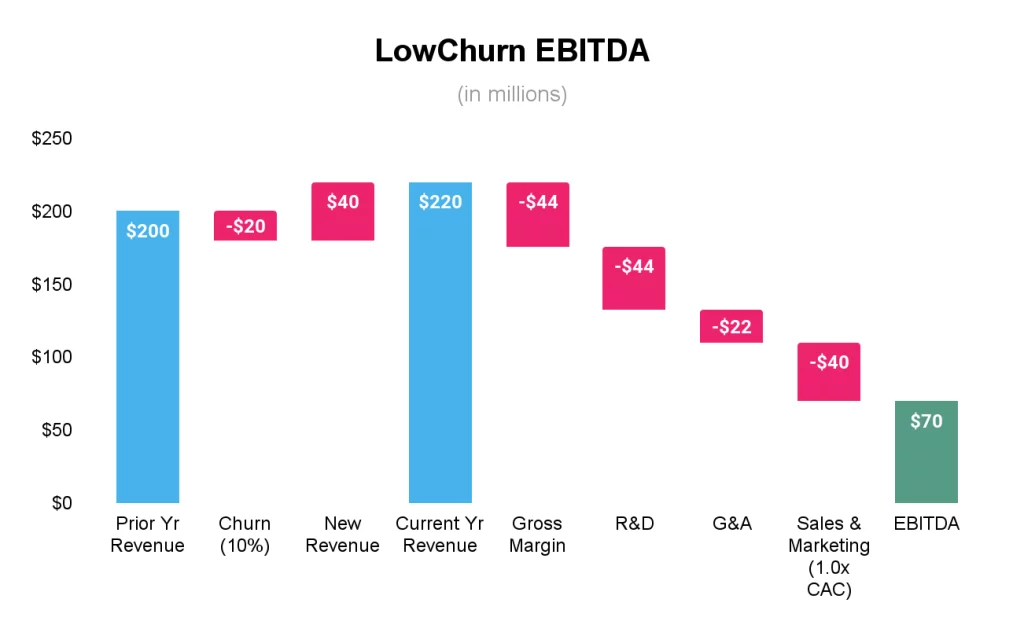

Let’s imagine there’s a SaaS company named LowChurn that matures at $200M revenue (pretty good!). If we assume 80% gross margins (world-class), this means LowChurn has $160M of gross profit. At scale, R&D might be 20% (or even 15%). 20% of $200M is $40M of R&D. And let’s assume G&A is 10%, or another $20M. So LowChurn’s Gross Profit minus G&A minus R&D is $100M. Sweet!

If churn is 10%, LowChurn has to “refill” $20M of revenue to get back to the prior year’s revenue. If we target 10% terminal growth, you need another $20M on top of that, so $40M total. If their Customer Acquisition Cost (CAC) has a 1:1 ratio to revenue, that means about $40M of Sales and Marketing. Take that out of the current year’s revenue, and LowChurn now has $70M of EBITDA (earnings before interest, taxes, depreciation, and amortization) or 32% EBITDA margin. Add that to the 10% growth rate, and you get a 42 on a Rule of 40—pretty good (though not amazing).

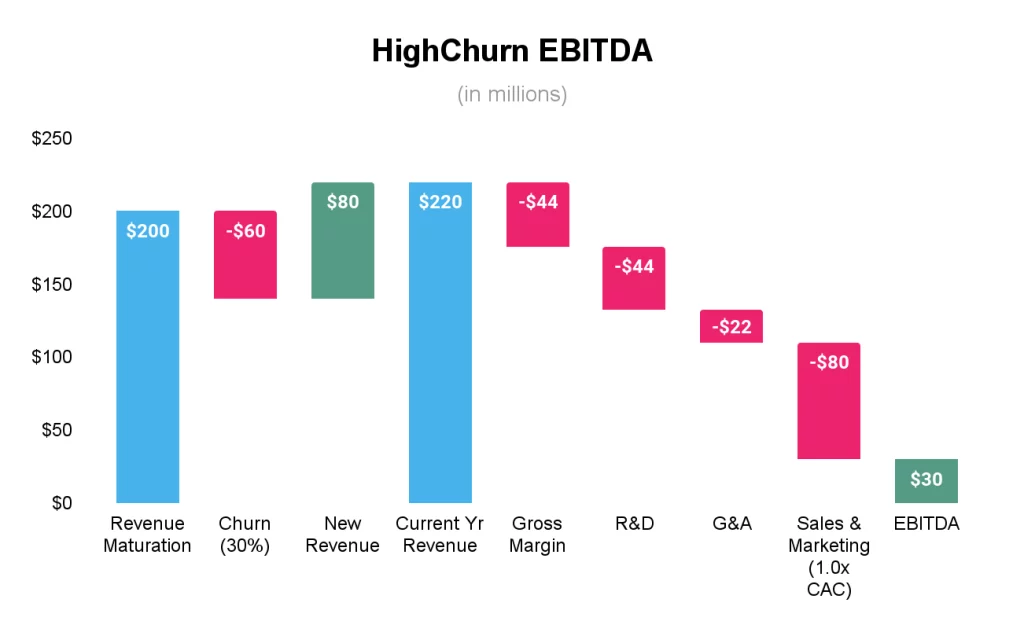

Let’s imagine a similar company with a great name like HighChurn—with 30% churn (ouch!). They have to “refill” $60M just to get to 0% revenue growth and another $20M to grow 10%. At a 1:1 CAC ratio, that means $80M of Sales and Marketing. So now HighChurn is only making $30M EBITDA or 14%. Add that to the 10% growth and this company has a mediocre “Rule of 40” of 24.

And it only gets worse …

2. Churn Means Your CS Costs Get Higher—and Maybe Gross Margins Get Lower

You might be asking at this point: “Where are your Customer Success costs?” Great point. Let’s assume they are in Cost of Goods Sold (COGS) in this example (whether they are in Sales and Marketing or COGS is irrelevant since the bottom line will be the same).

LowChurn likely has a sticky offering and doesn’t have to throw tons of free resources at customers to save them. So maybe their CS cost as a percentage of revenue is like 5% out of that 20% COGS in the example above.

But HighChurn is in trouble. They need to hire an army of people to reach out to clients and save them. They haven’t built proactive processes into the business. They haven’t used CS as a way to improve the product. They haven’t built an end-to-end journey.

So HighChurn probably says they “need to do whatever it takes to reduce churn.” Maybe they are spending 15% of revenue on CS—or 10% worse than the low churn company. This means the Gross Margin is now 70% instead of 80%. Guess what? Your EBITDA margin now dropped to 0%. Rule of 40 score is now a pathetic 10%.

Now you may be asking another question: What is the marginal value of CS investments? In other words, instead of high churn leading to high CS costs, you may have high churn because you have low CS investment. Modeling when a CS investment is accretive is an interesting question, though different from the point this post makes. Either way: high churn drags down all indicators of success—EBITDA, Rule of 40, etc., and a successful CS department can be directly tied to churn reduction.

But buckle up … we’ve got one more step.

3. Poor Customer Success Increases Customer Acquisition Costs

We assumed HighChurn has an efficient customer acquisition motion, showing up in spending $1 on Sales and Marketing for every $1 on new revenue.

But a high churn company won’t have this in their cards. HighChurn likely has lots of clients that try them and then leave. Shocker—those customers aren’t likely to come back. And when they switch jobs, they aren’t likely to buy HighChurn again. So you are effectively burning through the market like a forest fire. Eventually, you run out of trees.

HighChurn will have to do increasingly-desperate things to get new clients. They will price at the lowest level possible. They will use aggressive sales tactics. They will spend a ton on paid marketing.

Most likely, HighChurn has a much-worse CAC ratio of 2:1. So in our doomsday example, “refilling” $60M of churn and adding $20M of growth means $160M of Sales and Marketing! So now our once-profitable SaaS business is losing $60M. In other words, it’s worth approximately as much as FTX these days.

Conclusion

I don’t want to be a naysayer, but hopefully this post is a reality check. If your SaaS business has persistently high churn, you will likely never make money. And businesses that never make money aren’t worth 100x ARR or 10x ARR or even 1x ARR—they are literally worthless.