The paranoid CEO in me has been feeling better since last week’s survey results on what investors thought of the SaaS valuation collapse. Still, I wanted a more complete picture of SaaS’s trajectory in the economic downturn. Private Equity and Venture Capital firms may be aligned on priorities, but what about CEOs? Are there meaningful differences in opinion between Private Equity, Publicly-traded, and Venture-backed CEOs?

My latest survey got to the bottom of that. I asked similar questions, pushing them to rank initiatives, reveal cost-cutting measures, and prioritize go-to-market strategies in the downturn. And the glass remains half full for me after seeing the responses.

Without further ado, I present five lessons from surveying CEOs about the downturn.

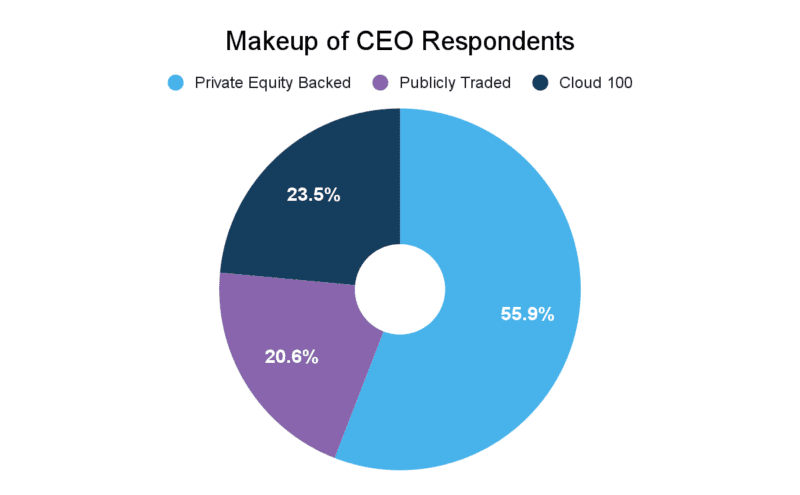

Who we surveyed

We surveyed a broad set of CEOs across those that were backed by Private Equity, those that were running public companies, and those that were on the Forbes Cloud 100 list.

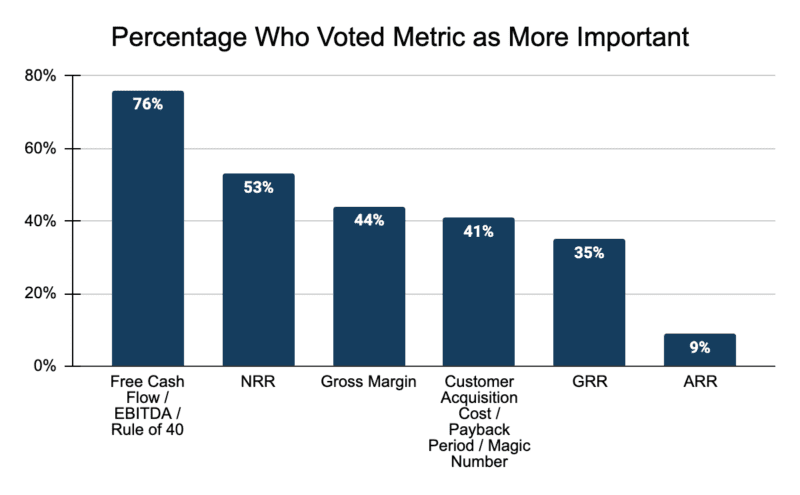

1. Rule of 40 and Net Retention are essential metrics

Like in the previous survey we sent to investors, CEO respondents were asked to rank various SaaS metrics as either “More, Less, or of Equal Importance” given the economic downturn. Their responses were filtered down and the results below show what percentage of CEOs ranked a metric as more important.

The Rule of 40 had the most overwhelming support. Virtually all respondents voted it as more important now, and that was followed closely by Net Revenue Retention. Even though CEOs voted the Rule of 40 as the most important, NRR was the only other metric that received a majority vote in every pool of respondents (Publicly-traded, Private Equity, and Cloud 100).

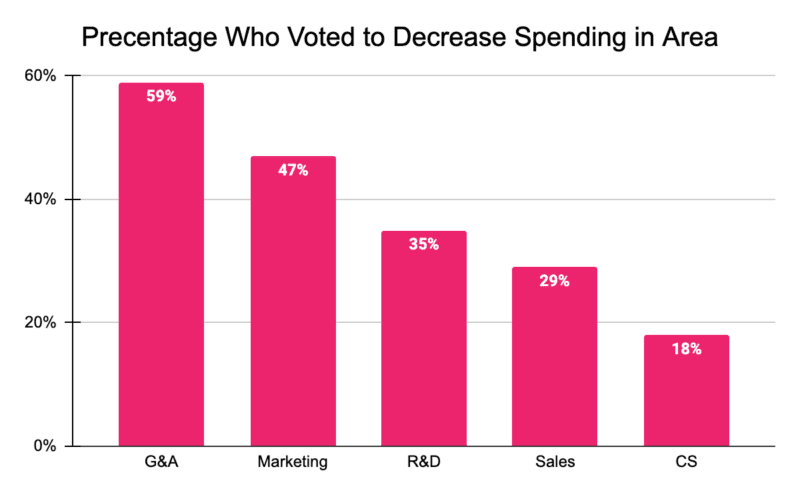

2. Funding for customer success is still prioritized

As proved true for our firms, SaaS CEOs also agreed that Customer Success should be the least likely to receive departmental cuts. Publicly-traded CEOs actually unanimously came to this agreement; not a single respondent there voted to cut CS.

This graph shows aggregated votes from all CEOs, like the last one. Across the board, every pool of respondents decided that G&A was most likely to be cut.

3. Growth must be strategic and reliable with fast payback

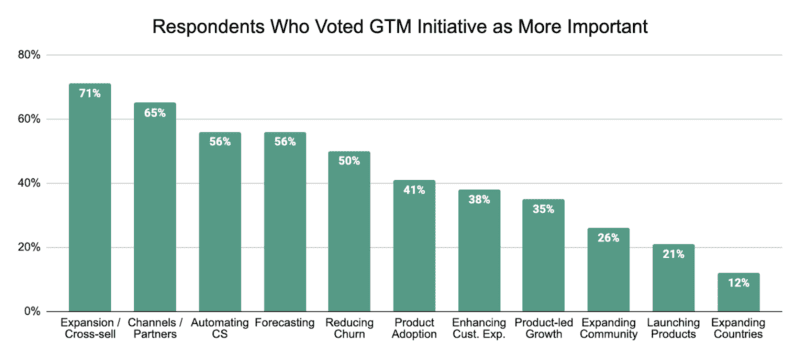

We asked CEOs to rank go-to-market initiatives in terms of which ones are becoming more important given the downturn.

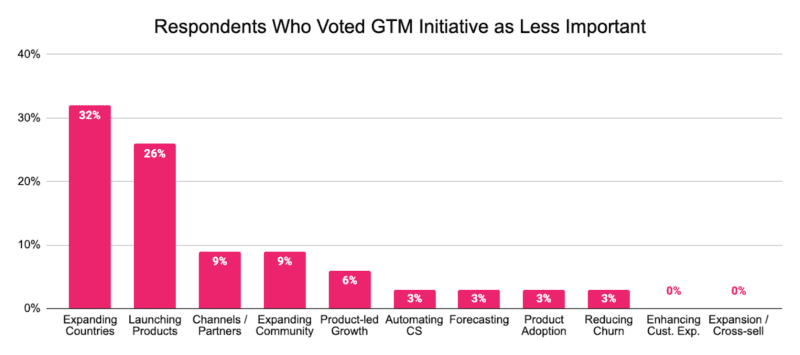

Cross-sell, Adding Partners, Automating Customer Success, and Improving Sales Forecasting all lead the way, and there’s a clear theme across these choices: durable and efficient growth. That sentiment is also reflected in the graph below, which asked respondents to vote for those initiatives they found less important.

4. Above all else, SaaS needs efficient growth

Our final set of questions offered an open-ended text box for SaaS CEOs to list their top priorities when investing in GTM initiatives.

This cloud reflects many of the graphs listed above, though “efficient growth” was an important commonality. Looking back on the graphs with their top-voted priorities (NRR, Cross-sell, CS, etc.), it starts to paint a picture of what the SaaS industry views as “efficient.” There’s one final data point to share, which generated a word cloud out of what CEOs are deprioritizing given the economic downturn.

G&A received votes for cuts across almost every respondent, along with hiring and aggressive expansion. Taking all of these points together, I have one final lesson to leave you with.

5. Durable and efficient growth FTW

At this point, the data speaks for itself. Investment firms and SaaS CEOs – across all different types of funding – view durable and efficient growth, as measured by Customer Acquisition Cost and Net Retention, as the inevitable future for us all. That future is paved with lots of uncertainty, but I’m remaining hopeful that we can get there stronger!

As the greatest philosopher of our times, Taylor Swift, once said, “I could build a castle out of all the bricks they throw at me.”